- We expect growth of over 5% in 2022 making the economic outlook published last week by Qatar’s statistical agency look pessimistic, even in their best case scenario, while growth may drop to sub 1% in 2023, below the economic outlook’s worst case.

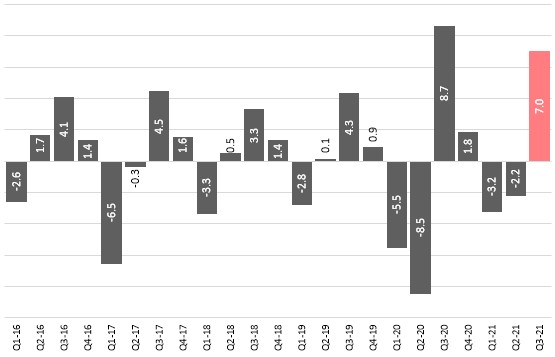

- Qatar grew 7% in the third quarter of 2021— while Q3 is typically a strong quarter, the high growth rate is a clear indication that the economy is ready to bounce back from covid once the all clear is given.

Qatar non-oil real GDP growth (% change from the previous quarter)

Source: Planning and Statistics Authority

Some more details..

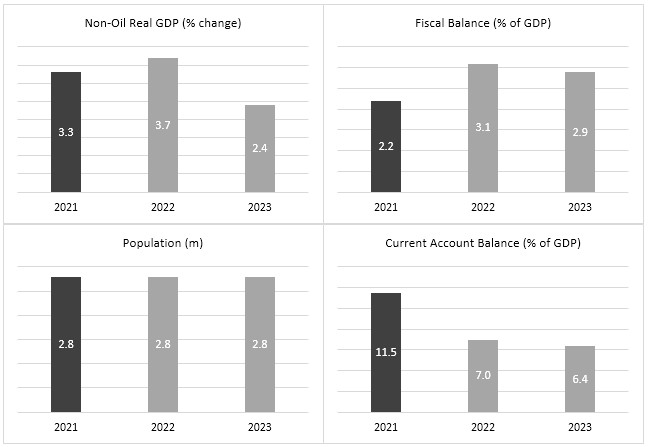

- Qatar’s official statistical agency published an economic outlook outlining three scenarios. The forecasts look pessimistic to us for 2022 and optimistic for 2023. We would expect non-oil growth in this post-covid Word Cup year to comfortably exceed both the medium scenario of 3.7% in 2022 and the optimistic scenario of 4.7% with booming construction and services, but to underperform the medium scenario of 2.4% in 2023, even coming in below the base scenario of 1.3% in that year, with construction and services both likely contracting somewhat and with the population falling slightly rather than remaining constant at 2.8m. However, in the longer term, growth will be driven by the rollout of the LNG expansion with substantial spillovers into the non-oil sector as well. We have written extensive technical analysis about this in the past so do get in touch if you would like to see previous reports on the topic.

Qatar Economic Outlook Forecasts – “Medium Scenario”

Source: Planning and Statistics Authority, Qatar Economic Outlook 2021-23, Issue Number 13

- The latest data released last week indicates that Qatar’s real non–oil GDP grew at a rapid 7% in the third quarter of 2021, almost back to the levels of production seen in Q3 2019. The acceleration in growth was driven by:

- a 28% increase in trade and hospitality, as local spending offset a lack of tourism

- a 5% increase in construction as projects press ahead for the World Cup, despite covid

- an 11% increase in financial and business services.

- Bloomberg reported that LNG prices continued to rise which will benefit Qatar’s exports as the state looks to offload a large volume of long term contracts in the near future.

This article is a small summary of a more comprehensive weekly GCC report. If you would like a free 4-week trial of our full report just email me by clicking here and request a free trial.