Weekly highlights

- Qatar World Cup tickets went on sale with 1.2m requested, but with Airbus cancelling a Qatar Airways order for 50 planes and a lack of budget hotel capacity, getting there and finding somewhere to stay are a concern.

- Houthi attacks on Abu Dhabi were designed as a threat of more widespread and substantial damage.

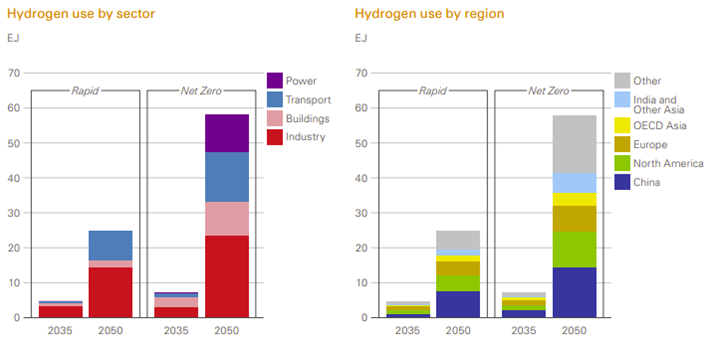

- A number of GCC countries are looking into hydrogen along with international corporate partners as a potential to replace hydrocarbons in their business models, but it is unlikely to be quite so lucrative.

Source: BP

- Oil prices are close to recent $90 highs as Russia/ Ukraine tensions feed supply concerns and demand remains stubbornly high despite Omicron.

Get in touch for a free trial of our full reports or if you would like to know more about any of these topics or would like to arrange a call with one of our analysts.

- Tickets for the FIFA World Cup Qatar 2022 went on sale with 1.2m tickets requested in the first 24 hours. Fans have applied for tickets priced at anywhere from £50 for the group stages up to £1,180 for the final (an increase of 46% from 2018). It would be wise to secure accommodation as soon as possible as it remains unclear whether Qatar will have the capacity, particularly in the segments below five or four stars, something we highlighted a year ago.

- Airbus revoked a $6bn order of 50 A321neo jets that was due to be delivered to Qatar Airways (QA). The move comes in response to QA claims for damages of $700m against Airbus as QA says it was forced to ground 21 A350s owing to surface defects. The cancellation of the Airbus A321neos will put QA under pressure to meet capacity for the World Cup.

- Hydrogen is attracting growing attention in the GCC but is unlikely to make a significant long term difference. A series of MoUs were signed between Saudi’s Public Investment Fund and Korean companies for a green hydrogen project while Aramco plans to produce hydrogen-powered vehicles that will be used by government entities. Meanwhile, in the UAE hydrogen production is becoming a priority and cash has been committed with international partners for green hydrogen production and hydrogen aviation fuel. Additional research and development in the hydrogen sector are also underway in the Emirates. And finally, Oman is working with BP to develop hydrogen along with other renewables. The GCC may have a competitive advantage in green hydrogen production owing to the low cost of solar power in the region, however, whether this advantage will be significant enough to make it competitive to ship hydrogen around the world rather than just produce it locally elsewhere, remains to be seen. Hydrogen exports are unlikely to replicate the scale in the GCC business model that hydrocarbons do today.