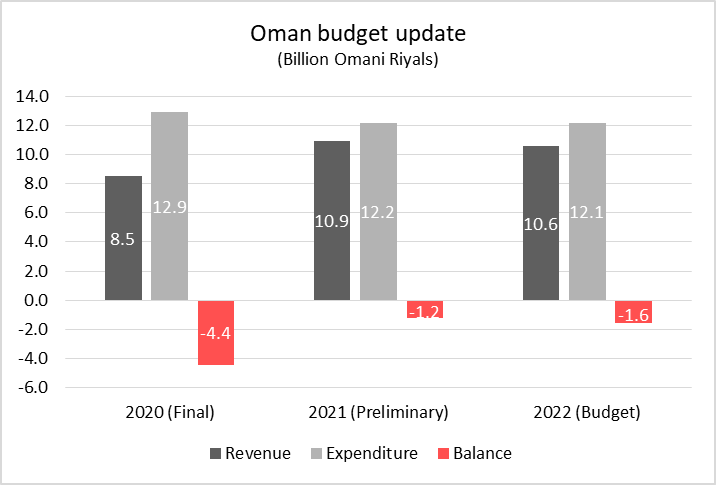

- Oman reported last week its lowest budget deficit since 2014 at 4% of GDP

- Higher oil prices were naturally the primary reason but consolidation is working with electricity subsidies down 24% and civil ministry spending (mainly wages) down 6%

- The outlook for 2022 is also positive with a projected deficit of 5% of GDP, although it is likely to be substantially lower or even a surplus given that the budget is based on a very conservative oil price of $50/ barrel

- The revenue base looks set for increased diversification with non-oil revenue expected to grow 21% in 2022 with higher takings of corporate income tax and VAT

- However, no major privatisations are budgeted and personal income tax looks set to be pushed back to 2023 at best

- Consolidation needs to continue – even with the improved budget dynamics, Oman remains dependent on high oil prices and still has $7bn of debt to refinance this year, which will prove challenging