Unity of the exchange rate is a signal of wider unity and good things to come

- Libya’s central bank followed through on the unification of the exchange rate on 3rd January 2021

- Furthermore, a ceasefire is finally holding, the appointment of a UN peace envoy is imminent and oil production is back at capacity

- These are all important indications of unity and a national effort towards economic reform and progress

- Libya’s potential is enormous and it is worth keeping an eye on

- The unified exchange rate will support the development of non-oil exports and will also assist with financial stability and eliminating distortions and corruption

- Conversely, the impact of the devaluation could be inflationary, painfully eroding real incomes

Unification and devaluation of the exchange rate

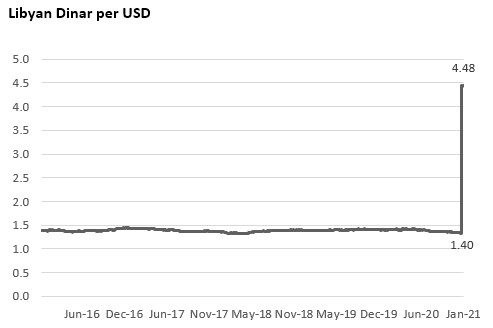

On 3 January 2021 the new, unified foreign exchange rate of the Libyan Dinar (LYD) came into effect. The decision was taken by the Central Bank of Libya (CBL) Board of Directors on 16 December 2020 when it was announced that the official rate of the Libyan Dinar would be adjusted from LYD1.4 per USD to LYD4.48, a significant devaluation.

The new exchange rate is available to citizens and businesses in all regions of Libya and at all commercial banks in the West and East of the country. The unification of the rate was taken in close coordination with the Government of National Accord in Tripoli which, at the same time, has suspended a tax on foreign currency transactions.

The unification of the exchange rate and removal of taxes on foreign exchange transactions will mitigate the distortions resulting from the black market operating in Libya and limit the potential for corruption by restricting access to preferential rates. It will ease the flow of foreign currency through official channels and support Libya’s economic recovery while also facilitating trade and finance. Cheaper prices of Libyan goods should also provide a boost to any export markets that might be developed in Libya in the future, oil excluded as it is priced in US dollars.

However, a devaluation of over 3x will inevitably push up the cost of imports with a short-term hit to prices and real incomes. There is a risk is that inflation becomes entrenched and destabilising, but sound management by the central bank should be able to avert this.

Foreign exchange limits set on business and personal transactions

The CBL has set a number of limits on the foreign exchange available for business transactions. The maximum value of a single letter of credit for the supply of commercial goods has been limited to $5m, for industrial goods to $10m and for services to $3m.

There are also limits set on access to foreign currency for personal transactions at $20k per person, per year, from all commercial banks in Libya. Additional annual quotas are permitted for medical treatment abroad ($20k) and tuition fees ($10k).

The unification of the exchange rate as well as these capital controls will increase financial stability by stemming the outflow of foreign exchange from Libya and helping to build financial reserves. The unified exchange rate will also reduce speculation on the devaluation of LYD and arbitrage between the official and parallel markets. It will also reduce the incentive to purchase foreign exchange to protect wealth and remove economic incentives for money laundering using fraudulent shipments.

We see this move by the central bank and the GNA as a very positive step towards the recovery of the country and its economy.